When it comes to running a property, operating expenses can cut into 50% of a property manager’s overall income. When these expenditures get out of control, net operating income (NOI) suffers. To avoid this, here are 6 ways technology improves net operating income.

Money-pit expenses can hurt even the most successful property manager’s NOI—they can even put you in the red.

We define “money-pit” expense as any (avoidable) expenses that drain a property manager’s (PM’s) financial resources.

Examples of money pit expenses include:

Smart technology helps reduce the cost of money-pit expenses like these by equipping PMs with smart devices that allow for 24/7 monitoring and response of their communities.

As a result, they are now able to allocate less of their budget to staffing maintenance personnel.

In addition to stemming the costs of money-pit expenses, a manager’s NOI can also be impacted by disasters like the ones described below.

(Here too, smart technology comes to the rescue).

Did you know that most renters insurance policies do not cover water damage as it applies to Liability Coverage?

This can leave PMs like you picking up the tab for these types of disaster-related expenses.

For instance, apartment flooding, which you can read about here, brings on a variety of spiraling costs.

These costs include

To combat this, smart technology boasts smart leak detectors which catch water leaks as soon as they occur, preventing costly damages like apartment flooding.

In recent years, an estimated 109,700 multifamily residential building fires were reported within the U.S. annually.

This resulted in an estimated $1.4 billion in property loss.

However, by providing managers with real-time smoke alerts, smart smoke detectors help to eliminate the risk of fire-related expenses.

These real-time smoke alerts are synced to a helpful app that can be viewed even if the PM is not on the property.

Limiting the excessive costs due to fire damage is just another example of how technology improves property managers’ net operating income.

According to the FBI, there were 346,312 daytime burglaries in 2018.

It’s also a well-known fact that residents are particularly vulnerable to break-ins and burglaries during the summer and holiday seasons.

As PMs are responsible for so many multifamily units (and even multiple communities in some instances), it’s simply not possible for them and their staff to be everywhere at once.

Additionally, a community’s vacant (or under-renovation) units are also vulnerable to break-in.

Even if it were possible to monitor every unit in a multifamily community in person, the staffing costs to do so would greatly decrease NOI.

On the other hand, smart entry sensors do this same work.

This easy-to-install technology enables PMs and residents to remotely access and monitor the status of their unit(s), oftentimes through one single app.

The resulting real-time response and notifications when motion is detected protect the property from unwanted intruders, driving down NOI costs in the process.

Why raise rent without raising the unit, as well as the community’s, value to the resident?

Thanks to the smart property automation features described above, property managers are now able to see robust profit margins while also providing residents with exceptional value.

With residents feeling more secure in their communities, PMs now have a welcome justification for increasing rent.

A happy resident is also a lease-renewing resident and it’s not a stretch to say that—given their newfound positivity regarding the management of their multifamily rental —residents will now recommend their new smart community to a friend.

This game-changer results in fewer vacancies and greater net operating income for property managers.

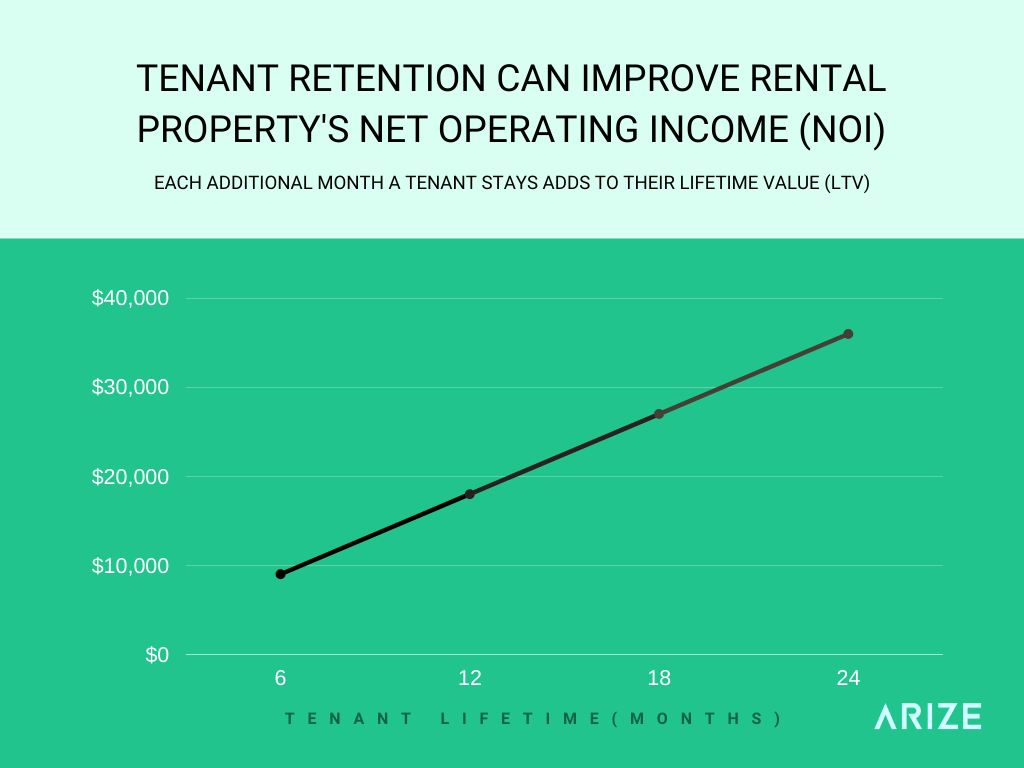

Research shows that each retained resident is worth an additional $900 each year, and that is in addition to their rent payments.

Given that rental units are vacant for an average of 1.5 months, property managers stand to save an average of $1,350 per retained lessee.

Here is an elaboration of the point above based on the Orange County market:

If your rental price is $1500 a month and the average resident “lifetime” is 20 months, that’s a lifetime value of $30,000. What if they stayed an additional 6 months?

That’s an additional $9,000 generated from each resident. Keeping residents in your unit means you won’t have to market vacancies, and on top of that, you don’t open yourself to the risk of renting to a non-paying or problem resident.

To be sure, happy residents and their lease renewals also drive profits in rental properties by eliminating the costs associated with vacancy and resident turnover.

Reduced expenses and greater resident retention thanks to smart property automation means greater NOI for managers.

Don’t allow your multifamily investment to slip into the red.

Get to your financial finish line more quickly by upgrading to a smart community today.

See how we helped one community save $250,000 in potential property damage expenses.

Whether you’ve faced economic setbacks or want to build resilience, learn how smart tech can help your business adapt and thrive.

See how IoT solves for common property issues, and learn about the 3 "C's" residents receive once they move into a smart apartment.

© Copyright 2023 Arize. All rights reserved. Various trademarks held by thier respective owners.